Finance Insiders’ Q3 Roundup for 2022

Welcome to Thought Logic’s Finance Insiders’ Q3 Roundup for 2022!

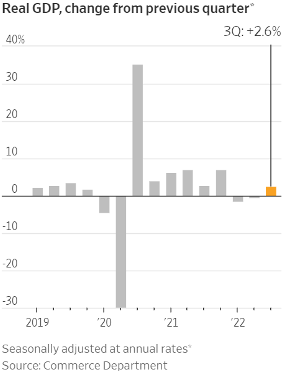

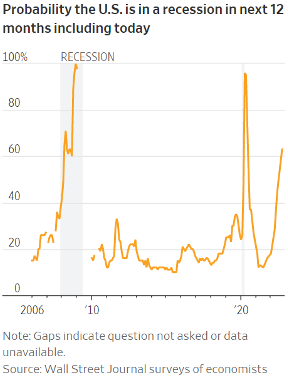

Earlier this year, we continued to see talent retention, inflation and geo-political tension shape the agenda of CFO’s. With the Fed’s determination to control inflation leading to monthly interest rate increases certain business segments have softened and investor confidence continues to be rattled and the major stock indexes have been volatile. The U.S. economy grew at a 2.6% annual rate in the third quarter but signals of a broad slowdown have heightened amid lessened consumer and business spend under the weight of high inflation and rising interest rates.

Our focus for this article is to examine levers that management should be taking now to prepare and protect against these external risks, up to and including a recession. We will explore efforts that should be prioritized inside your organization to maintain growth and transformational awareness.

Tighten Operating Expenses:

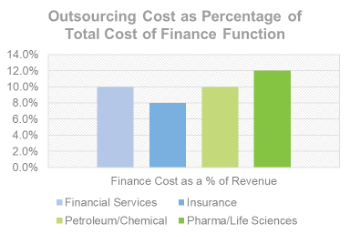

Reviewing and benchmarking SG&A and other operating expenses is critical to do every few years. It is optimal to analyze these expenses during periods of growth, but is also essential in preparing for periods of uneven demand. Knowing your SG&A spend allows you to calculate specific benchmarks as a percent of revenue, or margin or other factors to compare against your peers. Any indicators can be easily diagnosed to evaluate and implement an operating model that can scale effectively without allowing expenses to creep back leading to inefficient operations. In helping companies review their expenses, some of the common opportunities to optimize have been related to the following categories:

- Real Estate and Leases

- Maintenance and Repairs

- Advertising and Marketing

- Fleet Expenses

- Accounting and Audit Fees

- Outsourcing / Services

It is a necessary time to be diligent about indirect costs and understanding how they have a potential impact on the people or organization. Associates have a direct impact on customer experience and satisfaction, therefore reducing expenses may be tricky. Using industry benchmarks can help you avoid unnecessary cost.

Strategic Hiring / Headcount Optimization:

While the war for talent has been ongoing for years, the latest trends will likely make it even worse. Demographic shifts are already changing the labor market, and they will only continue to intensify. Companies that offer flexible work models have an edge in the war for talent, but the companies that can manage their workforce precisely will ultimately gain competitive advantages. For this reason, it is important companies move away from spreadsheets and truly focus on workforce planning solutions that are integrated to your ERP. The ability to plan, reconcile and optimize your headcount during this phase is crucial to competing in the war on talent but also managing through a recession.

Key attributes to workforce management decisions that is enabled by software will provide the following opportunities:

- Allows you to focus on your people and changing skillsets required, not spreadsheets.

- Your FP&A associates will spend less time gathering workforce data and reconciling errors and more time turning insights into workforce models and plans to provide your business partners.

- True scenario planning with your business partners. You should be able to tailor workforce recommendations across all lines of business to align compensation and hiring with future business trends.

- Allows you to work more strategically with the business to test hypotheses that map to business goals, like analyzing churn indicators to improve retention

Working Capital Opportunities:

Working capital and cash flow is top of mind as we are in a period of higher borrowing rates and companies also want to be in a position to take advantage of short-term opportunities should they arise. Managing working capital successfully allows you to meet your short-term expenses and are well-positioned to capitalize on opportunities to grow.

- Receivables optimization: Tightening your order-to-cash processes is the first step in then synthesizing internal and external data with automation and machine learning to protect revenue leakage and lift working capital by focusing on customers that pay on time. In addition, focus on automating invoicing and collections activities to reduce errors and limit disputes.

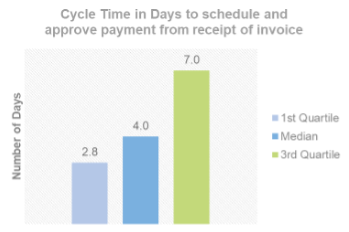

- Payables optimization: Work with procurement teams to rationalize payment terms among vendors, perform category analysis and contract adherence. Enact programs that offer vendors the ability to take a discount for early payments. In addition, companies should strive for efficient operations to keep costs in AP low.

- Inventory optimization: Consider integrating sales and operations planning to improve metrics around inventory, fulfillment times and back-logs. Using an integrated approach will facilitate better demand planning and ultimately lead to better inventory management and cash conversion.

Review Capital Expenditures:

The capital review committee should go through a rigorous review. The review process should include impact analysis to understand value delivered. It is important to understand the stage the capital expenditure in and confidence to completion to an asset. Following the review, companies should consider implementing a virtual portfolio management office. This ensures that the collection of projects chosen and completed meets the goals of the organization.

Critical activities that the portfolio management office will drive include the following:

- Establishing a viable capital and project portfolio mix that meets the goals of the enterprise

- Balances the portfolio against short and long term risk as well as fit for purpose

- Plan, Monitor and analyze the existing project portfolio

- Review new opportunities and align with the capacity of the organization

- Use standard financial metrics around ARR, NPV, IRR and payback to make recommendations to executive

In the short-term, the proper capital review will prepare the enterprise for necessary cost containment, while establishing a portfolio management office will instill the discipline required to balance capital growth with corporate strategy.

Product Profitability and Planning:

If inflation continues into the recession, companies will need a new strategy to combat rising supply chain costs as consumers will eventually look to price-switching. For this reason, it is imperative that regional and category CFO’s help their business partners address profitability, cost to serve and pricing mechanisms. Some consumer goods companies are increasing advertising on their premium brands as the public has shifted attention to more value products. All of the following analysis should be conducted to supply the right pricing methods:

- Perceived added value

- Volume adjustments

- Product bundling

Organizations that have invested in profitability and cost-to-serve models will have a competitive advantage heading into a recession. Companies that act now and build the proper analytics platform for their business will be more equipped to identify best products and services as well as the most profitable products and services.

Pre-Recession Scenario Planning:

It is important to develop a game plan and be prepared to adjust budgets and forecasts as necessary. To support better decision making, a key part of scenario planning involves creating high-resolution visibility on revenue, cost and spend related to critical recession response themes. Develop a plan to evaluate the impact a 5%, 10%, and 20% drop in sales will have. Figure out what cuts in operations are needed at each stage to stay profitable and maintain the right working capital ratios. Also, identify key customers and determine what would happen if one or more of those them were to be lost.

- Be sure to include the core management team in the process and allow the board of directors to review the plan and provide input. If tough decisions are to be made, business leaders will be expected to course correct in a matter of days, not weeks or months.

Outlook

While the remainder of this year will include additional rounds of scenario planning, capital and expense adjustments, all CFO’s should lay the ground work in 2023 with resources budgeted for the following areas: (1) Scaling automation programs and machine learning will be important to free-up resources. The business has to be driving the art of the possible which will enable technological advancement and ultimate success for the business. (2) Develop your ESG framework that is flexible for short-term guidance changes, but positions you to integrate ESG into normal operations. (3) Continue to invest in corporate performance and analytics improvements. Finance teams that have unified financial & operational insights will drive value by delivering the right information.

Thought Logic is flexible in its approach to drive success in your business. Our experienced consultants partner with our clients to achieve viable and sustainable outcomes.

Learn More >

About Digital Enablement

Thought Logic’s Digital Enablement smartSolution provides full-circle capabilities that help keep organizations keep ahead of digital change.

Sign up to receive future Insights in your email box.

Never miss an update.