Finance Capabilities of the Future: Part II

What are the Current Focus Areas for Finance Leaders in their Organizations and How Informative are Perceived Key Market Drivers?

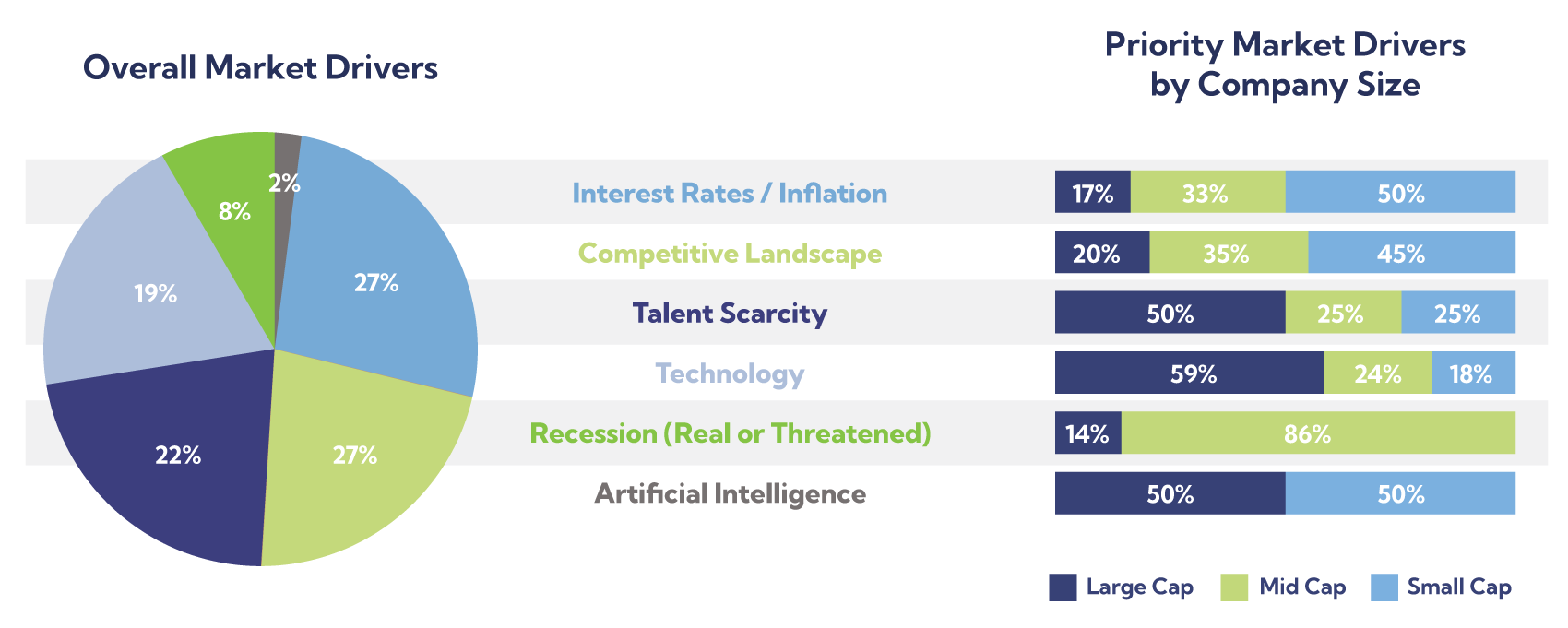

In a recent post, Thought Logic introduced a survey we conducted with our network of finance leaders to ascertain the relationship between their perspective on market drivers and their prioritization of finance capabilities in their business. Last time we revealed how various market drivers ranked as top-of-mind for respondents and highlighted the top 3: Interest Rates/Inflation, Competitive Landscape, and Talent Scarcity. Responses did vary drastically depending on company sizes, however, with small and mid-sized companies often voting to the reciprocal of large companies.

In this posting, we will review the responses for top priority finance capabilities from our survey. The questions focused on 8 major organizational capabilities relevant to a finance team:

- 1Talent Development – Prioritize talent development to ensure they have the skills and expertise needed to succeed in a rapidly changing industry

- 2Organizational Change & Operating Model – Make the finance organization faster and leaner by defining the right priorities and people for transformation

- 3Function Process Improvement – Standardize, optimize, and document business processes to improve upon existing finance functions

- 4Look Beyond Transactional Activities – Shift focus from low-end to high-end automation and make better use of staff time spent on value-added activities

- 5Digital Transformation & Technology Strategy – Evolve the technology landscape by investing in new technologies, enabling a more agile and business-centric finance organization

- 6Data & Analytics Strategy – Improve finance data analytics by utilizing advanced data aggregation and visualization tools. Ensure accuracy and availability through data governance

- 7Alignment of Spend & Growth – Become more active in managing capital to respond to changes in enterprise value drivers

- 8

Cash Flow Management – Improve quality, speed, and accuracy of budgeting and forecasting for better financial data management and visibility

Priority Finance Capability Areas of the Future

From the survey, most respondents focused less on Processes and more on People, Insights, and Technology capabilities. Findings indicate that people, data, and cashflow management are of most importance. Of the capability areas listed, large and small cap companies place an inverse level of perceived impact, while mid cap companies vary in their response.

Technology and People proved the top focus areas for finance leaders in their organizational capabilities. Once again, there was a disparity in responses depending on the company size of those surveyed; however, there was not as much alignment between small and mid-size companies as in the market drivers results. All three company size groups prioritized different focus areas. Large companies emphasized efficiency in resource utilization as well as investments in more costly automation and digital transformation. Smaller companies prioritized cash flow, spending, and growth, while mid-size returned an overwhelming emphasis on change, operational, and process improvement. Not surprisingly, the availability or limitations of capital is certainly comparable to company size and surely impacts finance leaders’ organizational strategies, but perhaps a larger discussion is understanding how market drivers inform the investment focus of larger companies and the budgetary discretion of smaller companies, for example.

Priority Finance Capability Themes

Survey Results

Respondents favor capabilities from the Insights, Technology, and People categories over Processes as the most important focus areas of their company from a finance and accounting perspective.

How much of capability prioritization is intentional proactivity and how much is reactive? Are successful, future-focused leaders consistently ahead of the game in correctly perceiving the most influential market drivers and responding accordingly? Lastly, how changing are these perceptions and goals, year over year? Follow our LinkedIn for continued insights from this study.

For more questions on this survey or to start a discussion with our Finance Practice on how market drivers are impacting the financial strategies and functional capabilities of your own team please contact Daniel Boyles.

Authors

About Digital Enablement

Thought Logic’s Digital Enablement smartSolution provides full-circle capabilities that help keep organizations keep ahead of digital change.

Sign up to receive future Insights in your email box.

Never miss an update.