Corporate Finance Capabilities of the Future

What are the Current Focus Areas for Corporate Finance Leaders in their Organizations and How Informative are Perceived Key Market Drivers?

In today’s rapidly evolving business environment, Finance Leaders face significant challenges driving sustainable growth and budgetary resilience. As the architects of corporate financial health, they must manage cash flow effectively to maintain operational liquidity and fund strategic investments. Risk management also becomes more complex with economic uncertainty and regulatory changes require more dynamic and robust strategies to mitigate threats. Improving the efficiency of financial operations is essential to stay competitive and adapt to technological advancements. Additionally, as the volume and extensity of data grows, finance Leaders need to optimize data management to extract actionable insights and inform decision-making. The ability to successfully identify the driving market forces on financial stability and proactively manage business capabilities in response will shape the exemplary finance functions of the future.

At Thought Logic Consulting, we sought to pulse our own network of corporate finance leaders for their insights and perspectives on future finance capabilities, as well as which market drivers they identified as most impactful to their company and the finance organization.

We surveyed a range of finance leaders across various industry and company sizes on two major focal points:

Market Drivers

Which 3 drivers are top of mind for Finance and the Company?

Finance Capabilities

Which capabilities are of top priority in the next 3-5 years?

Does company size affect the perception of market drivers or focus across organizational finance capabilities? Are finance leaders prioritizing the right capabilities to capitalize on the market drivers they deem most important?

Respondents were provided with the following 6 corporate finance market drivers to consider:

Finance – Competitive Landscape

Understanding the competitive landscape around pricing dynamics, supply chain disruptions, and executing M&A opportunities

Financial Health and Interest Rates / Inflation

Monitoring these economic indicators is crucial for shaping monetary policies and investment strategies, influencing the overall financial health and stability of the organization

Financial Management and Recessions

(Threatened or Real)

The process of a recession poses significant challenges for finance organization. Proactive measures and adaptive strategies become imperative to weather economic downturns, safeguarding assets and sustaining operational viability

Financial Talent Scarcity

As demand for specialized expertise rises, how are finance organizations implementing strategic talent acquisition and retention initiatives to sustain a competitive advantage?

Technology Impacts on Corporate Finance

Embracing innovative financial technologies enhances operational efficiency, but also necessitates continuous adaptation to remain abreast of industry advancements and regulatory considerations

Finance AI Implications

Navigating data privacy, regulatory, and operational implications of AI becomes a central focus to harness its transformative potential in the financial landscape of automation, data analysis, and decision making

From the results, a trend that was the focus placed on interest rates and inflation which, in a less undulating economy, shouldn’t have to be a top-driving influence, but because of this, forecasting cash flows has become a higher priority in finance organizations. Whereas traditional forecasting would focus more on P&L or business panel forecasting. Respondents, in the near future, are instead focusing more specifically on cash flows and gathering the right data sets to inform their strategy.

Corporate Finance Market Drivers – Survey Results

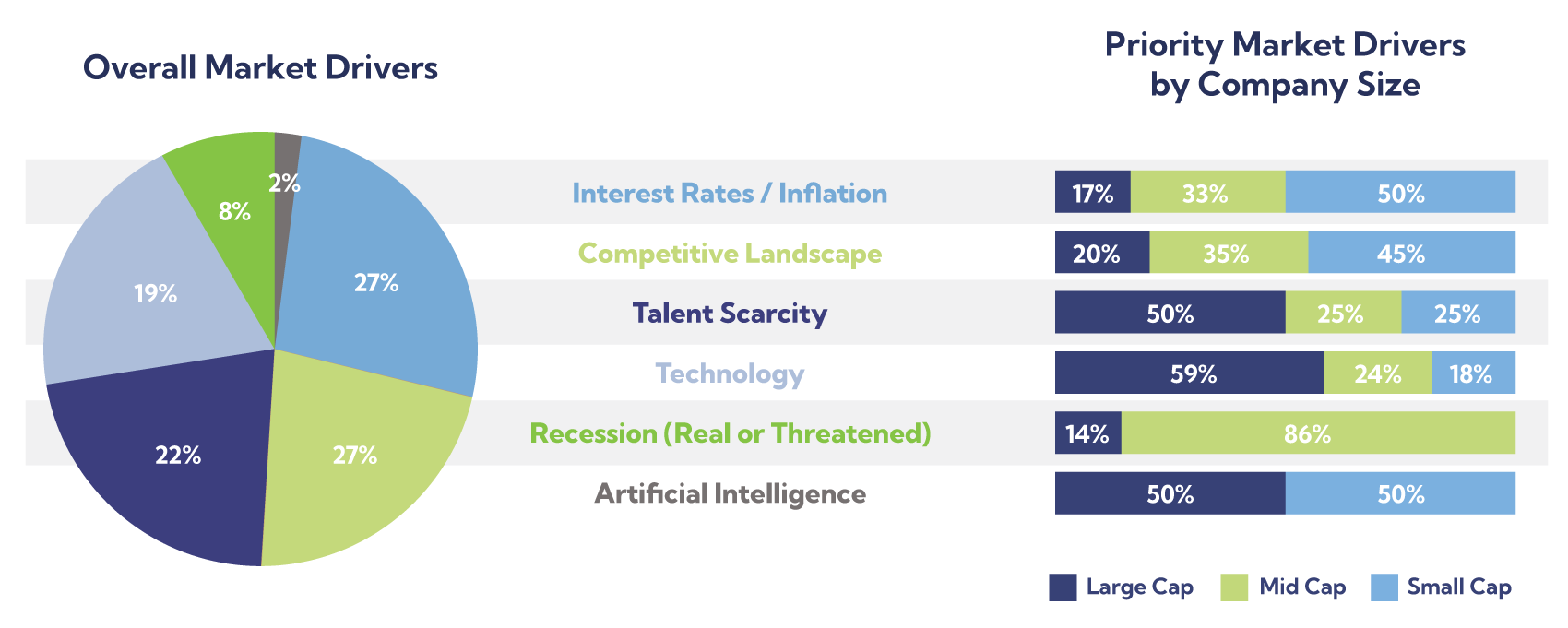

Overall, respondents recognize purchasing and borrowing power, industry forces, and talent strategy are the most impactful for success, however, small and large cap companies vary their point of view on the impacts of a recession.

Despite the rapidly growing predominance of AI, it rated lowest in importance in overall rankings. Breaking the results down by company size, however, reveals that, while mid-sized companies brought the average down, large and small companies actually ranked AI comparatively high to other market drivers. It will be interesting to observe any changes to this dichotomy of perceptions in the near future. Overall, the top-ranking market driver was Interest rates/Inflation, but—once again—perspectives were split if compared by company size. Mid and small-sized companies agreed with the importance of macro-economic health, while large companies—perhaps because of their inherent capital buffer—rated this driver among its lowest of influence. In our next post, we will look at the survey results for financial functional capabilities and how they rank as key areas of focus for financial leaders. How much consideration is given to market drivers by these leaders in their prioritizations and strategic planning? Will answers vary as drastically by company size or will respondents be more aligned in their considerations? Follow us on LinkedIn for continued insights from this study.

For more questions on this survey or to start a discussion with our Finance Practice on how market drivers are impacting the financial strategies and functional capabilities of your own team please contact Daniel Boyles.

Authors

About Digital Enablement

Thought Logic’s Digital Enablement smartSolution provides full-circle capabilities that help keep organizations keep ahead of digital change.

Sign up to receive future Insights in your email box.

Never miss an update.